When many overseas car companies have announced the first quarterly report of 2018, many domestic companies have just released the 2017 annual report.

what? Do you know that the domestic car company's 2017 profit figures were known two months ago? It was a short notice that had not been finalized. Some companies even released profit forecasts without revenue, and there may be a gap between the actual figures. If you want to make a complete and reliable comparison, you must wait for the annual report to be open.

Finally, the last batch of annual reports surfaced at the end of April. The slight increase in sales volume has become the keynote of the Chinese auto market in 2017, but the nature of cyclical fluctuations has been irritating. In the future, as the automobile society matures and transforms, new directions such as new energy and intelligence will release a wave of demand, and the market potential can still be expected. The financial performance of major car companies in 2017 has also become an important tip for the industry in the future.

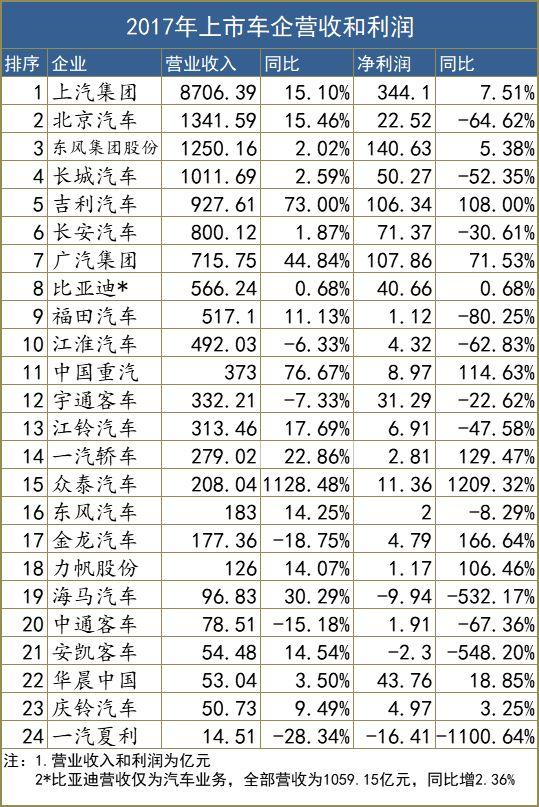

From SAIC Group, a leading passenger car company, to China National Heavy Duty Truck Group, a commercial vehicle giant, “Daily Cars†has compiled statistics on the performance of 24 listed vehicle companies and conducted horizontal analysis on various dimensions such as operating income, profit, and sales volume. The data can speak, even if it is not a comment, one by one the number and juxtaposition has its natural connotation.

Perhaps those who look at the surface only see that SAIC continues to occupy sales, revenue, and net profit. They feel that the performance of car companies has not changed significantly compared with previous years; however, if they go deeper, some car companies will go from The profit earned on the car body can be close to ten times that of SAIC Motor. Although some car companies do not have outstanding operating income, they enjoy the profits made by the joint venture company. The performance of commercial vehicles and passenger car companies also shows different characteristics...

Who is the most profitable Chinese car company? Who is seemingly full and extraordinarily weak? The answer to this topic will emerge from many perspectives and in-depth analysis.

what! SAIC's revenue actually compares to other sums?

If SAIC's operating income and profits do not take the domestic first, it is news. In 2017, there was no accident and SAIC Motor continued to reconnect with several “big indicators†such as production and sales scale, revenue, and profit. SAIC-GM/SAIC-GM and other veteran joint ventures, SAIC-GM-Wuling The SAIC passenger cars that have advanced into the top ten passenger cars have collectively exerted forces, making SAIC's leading position even more prominent.

However, what are the advantages of SAIC? This is a topic worthy of quantitative calculation.

The data under comparison is more convincing: In 2017, SAIC Motor Group’s revenue was RMB 870.657 billion, while the second-named Beijing Automobile’s revenue was only RMB 341.459 billion. The first SAIC was six times that of the second BAIC. The operating income of the 2nd to 24th car companies was added up to a sum of RMB 96,246.48 million, which means that the SAIC Group’s revenue accounted for half the revenue of the entire listed car company.

Of course, many auto groups did not pack all their assets when they went public. Therefore, the revenues of listed companies do not always equal the revenues of the entire parent company group, and may not reflect the complete strength of the company. SAIC's overly obvious advantages make people have nothing to say.

SAIC’s revenue advantage over other car companies is even greater than its sales advantage. In 2017, SAIC Motor’s sales of nearly 7 million units were about twice as high as the 3.28 million units of Dongfeng Group, but revenue was nearly 7 times higher than the latter’s RMB 125 billion. SAIC Group has more than doubled the sales volume of Guangzhou Automobile Group, but the revenue difference is more than 10 times.

However, revenue and profits are the same as condolences. Due to the existence of joint venture companies, whether the joint venture or associated company is completely included in the statistics will have a great impact on the figures. Taking Guangzhou Automobile as an example, the Group's total operating revenues totaled approximately RMB 337.773 billion, together with joint ventures and associates, representing a total operating income of RMB 75.175 billion in the combined statements of the GAC Group, the former being more than four times that of the latter.

However, if SAIC directly adds to the total income of the joint venture company, what kind of situation will it be? According to the “2016 List of Top 30 Chinese Automobile Industry Revenue Companies†issued by China Machine Association and China Automotive Industry Association, SAIC Motor’s total operating revenue in 2016 was RMB 1,596.647 billion, which is equivalent to the sum of the 2nd to 5th revenues. If the total sum of the top 30 revenues is added, SAIC Motor’s group revenue accounts for one-third of the top 30. With this obvious data for comparison, SAIC does claim to be the most local and most profitable car group.

Of course, in addition to SAIC's special eye-catching, the revenue growth of several automobile enterprises such as China National Heavy Duty Truck, Geely Automobile, Guangzhou Automobile Group is also very rapid, which is mainly due to the growth of product sales. For example, because of the rapid growth of the commercial vehicle market this year, Cnhtc has brought about strong sales and revenues, and several companies such as Geely and Guangzhou Automobile have launched explosive products, and the prices of bicycles and sales have continuously improved. The double harvest of revenue and profit.

Five net profits doubled, and Shali’s loss exceeded revenue

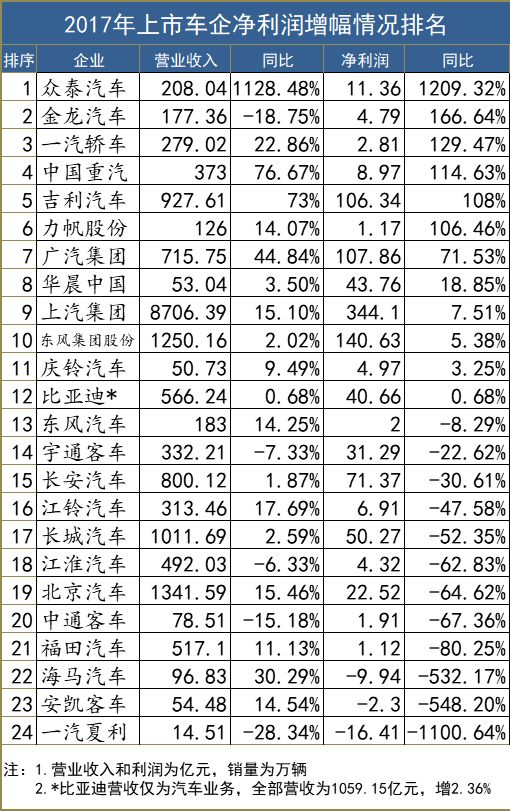

Due to the availability of data and the difference in the starting point of observation, the automobile industry pays much attention to the sales of automobile enterprises, and the attention paid to the distribution of profit of automobile enterprises is significantly reduced. But changes in sales and revenues are far less volatile than profits. If two or three percent of sales volume changes are substantial fluctuations, and profits can even double or turn from profit to loss, the three-four-digit increase or decrease is not uncommon.

Thus, in the face of profit indicators, the transcripts of various car companies have opened up the gap. "Icefire and two heavy heavens" describe the contrast in sales. It is not as good as describing the profit-loss gap.

In terms of net profit, SAIC's 34.41 billion yuan has left other companies far behind. Dongfeng Group, Guangzhou Automobile Group and Geely Automobile all achieved a net profit of 10 billion yuan. In particular, a significant proportion of GAC comes from Chuanqi to autonomy, Geely is purely autonomous, and the gold content is very prominent. It is worth mentioning that Great Wall Motors has had billions of profits in previous years. However, last year, due to the increase in marketing expenses, R&D investment, and sales decline of Haval, profit was low. In 2016 and 2017, Geely and the Great Wall almost exchanged profit figures.

Compared with the absolute value of profits, the rate of change in profits may be even more surprising, in which statistical factors have magnified the effect. Last year, Zotye Motor unexpectedly won the first net profit growth rate, an increase of 1,209.32% year-on-year, while operating revenue also achieved a tenfold increase. How can Zotye, a car company that imitates its origins, achieve such phenomenal growth? Looking back at the annual report of Zhongtai Auto, it is not difficult to find that the acquisition of Yongkang Zhongtai by Golden Horse was a wholly-owned subsidiary and the company’s main business changed. Therefore, the situation of Zhongtai is rather special and does not have the actual value of comparison.

Jinlong Motors, which ranked second, is also special. In the previous year, Jinlong Motor’s net profit loss was 700 million yuan. In 2017, it achieved profitability and reached 470 million yuan, which also doubled the year-on-year increase in net profit. This situation is similar to that of the third-ranked FAW Car. In 2017, the net profit of FAW Cars made a turnaround. Compared with the loss of RMB 900 million in the same period of last year, it achieved a profit of RMB 281 million in 2017.

Ranked fourth in China's heavy truck, net profit increased by 114.63% to 897 million yuan. As the heavy-duty industry closely related to the country’s macro economy, under the macroeconomic background of stable “increase in stability†and the initial success of supply-side reforms and increasing investment in infrastructure projects, the market capacity of construction vehicles continues to expand, and the road freight volume has steadily increased. At the same time, due to the implementation of the new GB1589 standard, “9.21 oversizing†and more stringent environmental protection policies, the heavy truck market has seen explosive growth. China National Heavy Duty Truck has become an outstanding representative in this market.

The previously mentioned Geely and Guangzhou Automobile not only ranked first in net profit, but also in an encouraging increase. Geely can even be said to be the highest growth rate among passenger car companies after excluding special circumstances, an increase of 108% year-on-year to 10.634 billion yuan. The explosive growth of profits cannot be separated from Geely's efforts in product and marketing in recent years. Almost every area has a good performance, which makes Geely become the most successful autonomous car company representatives. GAC also achieved a profit growth of over 70%. Chuanxi, as the “new locomotive,†has driven growth, and has also entered the exemplary sequence of excellent independent brands.

However, the high scores of the past year will become the more difficult threshold for this year. The "top students" of Geely and Guangzhou Automobile, who can climb up more persistently, will determine who is a better representative of independent companies.

In addition to listed auto companies with doubled growth rates, not all profitable car companies are in the minority. Besides Beiqi, Great Wall, Jianghuai, Jiangling, etc. For digits or even four-digit car companies, a drop of more than 100% means that they have turned from profit to loss.

For example, Haima Motor's net profit fell by 532% to a loss of 994 million yuan; Ankai's passenger car net profit fell by 548.2% to a loss of 230 million yuan, or the sharp drop in profit due to the decline of new car sales, or the subsidy deficit due to new energy policy Caused.

Of course, the most serious case was FAW Xiali. The sales volume drop of 26% not only brought the bottom of operating income, it was 28.34% lower than the same period of last year, and the net profit was even a loss of 1.641 billion yuan. Even the loss was far beyond the operating income of the company, resulting in a net profit. The year-on-year decline was 1100%.

Obviously, the main reason is that because the replacement has not kept up with the rapid development of market demand, the company’s production and sales scale has decreased, the brand has been weakened, and the Xiali brand has ceased production due to snow and other factors. This is not the case for the future FAW Xiali. Too many cards that can be handed.

The Brilliance that lies down to make money is the weakest among self-owned companies?

Revenue reflects business volume, profits reflect the scale of making money, and profitability reflects the efficiency of making money. Among the 24 listed vehicle companies, the highest net profit was accidentally dropped on Brilliance China, operating income was only 5.3 billion yuan, but net profit reached 4.376 billion yuan, and the net profit margin was 82.5%. It is 20 times that of SAIC. What's going on here?

In fact, it is not difficult to find out if Brilliance’s profit contribution is analyzed. BMW is a profitable dairy cow. In the Brilliance China’s annual report, “BMW's contribution to the Group's net profit increased by 31.0% from 2016's 3.998 billion yuan to 5.238 billion yuan in 2017.†While others are still concerned about profit and sales, Brilliance can be described as lying down. The rhythm of making money!

However, Brilliance’s report card is not only unrelated to honor, but fully reflects Brilliance’s own weakness. Among the larger independent car companies, Brilliance can be considered the most backward one. What? In 2009, Brilliance China sold the Chunghwa Jinbei Automobile’s Chungpae sedans business to its parent company, Brilliance Automotive Group, which means that starting 9 years ago, Brilliance China’s autonomous passenger car segment was not in the listed company’s asset sequence. Brilliance V3's monthly sales of 20,000 fell to its current three-digit sales during the peak period, Brilliance V6's sales are difficult to achieve major breakthroughs, and independent technologies continue to fall outside of the foreign side's reliance... These have given regret to the profit brilliance of Brilliance’s listed companies. brand.

Aside from China Business, other proprietary Brilliance businesses included in listed companies are also at a loss. After deducting BMW's 5.238 billion contribution, the net loss reached 862 million yuan, which is almost the level of the hippocampus.

The truly gratifying rate of profit depends on several “top students†such as Geely and Guangzhou Automobile. In addition to Brilliance, GAC, Geely, and Dongfeng have also achieved double-digit net margins, which is enough for the industry. Luxury cars such as Mercedes-Benz BMW have a net profit rate of around 8% to 9%. , So what are the reasons leading to GAC and Geely have such a high net interest rate?

It is not difficult to understand that since GAC and Dongfeng have a large number of joint ventures, they only count the profits of their shareholders at the time of calculating their revenue, and some of the revenue expenses are accounted for in the Chinese statements. This point is somewhat similar to the private company Geely Automobile.

Geely Automobile is a subsidiary company of Geely Holding Group. In terms of huge expenses such as operating expenses, especially for R&D projects, the sponsor becomes the parent company of Geely Automobile. From the Geely Automobile Report, it is almost only 2-3 billion yuan in research and development every year. Investment, accounting for less than 1% of revenue.

However, in fact, Geely Automobile once disclosed that Geely's R&D investment accounts for more than 10% of the revenue each year, which has enabled Geely Automobile to have its current development momentum. Analysts believe that this kind of operation can provide Geely with a considerable amount of net profit data, which is more favorable to the increase in stock prices and the inflow of capital. At the same time, R&D into the unified management of group companies can also maximize synergies. .

Who sells a car net earn 50,000?

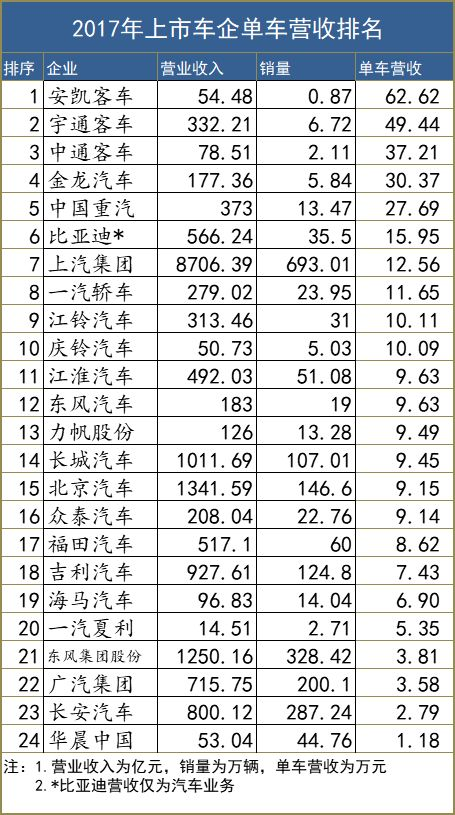

"Daily Auto" believes that judging whether a car company has a strong competitive edge not only needs to look at revenues and profits, but also depends on bicycle revenue and bicycle profits. Obviously, these two indicators for evaluating the quality and efficiency of sales are the most effective ones. Reflects the health of this company.

From the perspective of revenue, the highest single-vehicle revenue was in the area of ​​passenger vans and new energy. As a result, two bus companies and a heavy-duty truck company took the list of bicycle revenues. It is not difficult to understand that the price of a passenger car or a heavy truck is not cheap at a single bicycle price, which is often between RMB 400,000 to 500,000 or even higher.

Especially when it comes to new energy, the sales price is even more expensive. For example, the BYD K9 electric bus has a domestic price of up to 2 million yuan, but the export price is even more expensive. This is why BYD’s revenue is in terms of bicycle revenue. Closely follow the reasons for bus companies and heavy truck companies.

Unlike cycling revenues of up to RMB 620,000, Brilliance’s bicycle revenues were as low as RMB 11,800, which is several times that of mainstream auto brands. Revenue is low, independent of the loss, this is the truth of the performance of Brilliance. As mentioned above, the profits of Brilliance listed companies have contributed to BMW, and the autonomous sector has suffered serious losses. For example, only one Huasong brand had a loss of up to RMB 700 million. Although Brilliance’s bicycle profits appear to be as much as 9,800 yuan, it is in fact relying on BMW’s share of profits to pull out the quagmire of losses and create a superficial prosperity.

Cycling profits, Yutong bus occupied the top spot, selling a car net profit of 46,600 yuan, but in fact the passenger car industry in the past two years suffered by high-speed rail and private car consumption, sales fell sharply, revenue fell, but with new energy With the subsidy and passenger service transformation brought about by the development of the automobile, the Yutong bus book data still achieved a good performance.

Although the profit of the second-ranked BYD bike is 11,500 yuan, in fact, BYD’s net profit of 4 billion includes other business segments. Therefore, strictly speaking, BYD’s cycling profit is still less than 10,000 yuan, but it is represented by the transformation of new energy. The car prices, BYD is not the original BYD.

The gold content depends on Geely. Its bicycle profit is as high as RMB 8,500, which is far higher than that of GAC, SAIC, and Great Wall. The hidden strength of the company's ability to earn money should not be underestimated. Contrastingly, Jianghuai Automobile, whose profits have fallen by 60%, has lost its profit to 800 yuan. This year, Jianghuai Automobile experienced a slump in sales. The amount of small-sized SUV models dropped from the highest monthly sales of 20,000 units to more than one thousand. The sales target was only more than half of the sales volume, and it had already fallen out of the top ten of its own brand, if not for the commercial vehicle industry. JAC's revenue provides nearly half of the support, and JAC's entire business performance will be even worse.

On the whole, this large and late annual performance summary has infinite connotations under the digital representation. Some people move forward steadily. Some are ensnared, others are new, some are false and prosperous, and all kinds of complicated situations are intertwined into the status quo of the industry. Fortunately, the overall situation is in progress.

Here is just to analyze the two basic indicators of revenue and profit, the future "Daily Automobile" will focus on the joint venture car prices / sub-sectors, subsidy, R & D investment and other indicators to deeply deconstruct the Chinese car enterprises report card, so stay tuned!

Balance Valve,Automatic Balancing Valve,Pressure Balance Valve,Flow Balancing Valve

Wuzhong Instrument Co., Ltd. , https://www.wzivalve.com