Being overtaken by GM and Volkswagen, Toyota's prediction that it has fallen from the throne of the world’s leading automobile industry leader is likely to come true this year. The biggest factor behind this is Japan’s biggest natural disaster in the near future—the “3.11†earthquake. So far, two months have passed since this extremely destructive earthquake, but a series of follow-up impacts have continued. The entire automobile industry in Japan is still implicated, affecting the world. As Toyota at the center of the vortex, whether its position and share in the global market will severely weaken the earthquake has received widespread attention.

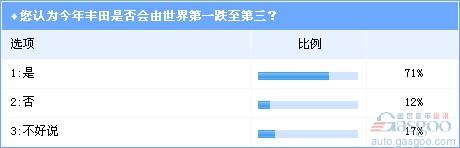

Some agencies predict that Toyota’s global sales will fall below 7 million vehicles in 2011 under the impact of the financial crisis, the global large-scale recall incident and the earthquake. This means that Toyota’s global ranking is likely to be in the General Motors and the Volkswagen. after that. In our latest issue, 2916 industry participants were attracted to participate in the voting. The results of the industry survey focused on this topic also showed (see Figure 1). Those who accounted for 71% of the total number of voters think that this year Toyota will fall from the number one in the world to No. Third, only 12% of those who hold opposing views, while 17% are still waiting to see.

This judgment is not without reason. In 2010, Toyota, which suffered from global recalls, ranked first in sales of 8.42 million units. GM and Volkswagen each ranked 8.23 ​​and 7.14 million. According to our comparison of the growth rate of the top ten auto giants in the global sales ranking in 2010, Toyota's 7.7% year-on-year increase was only 4.8% higher than that of Honda. Both were lower than the other eight companies and were aggressively chased by General Motors. Next, it is not easy for Toyota to sit in the top spot. At the same time, in the current rapid rise of GM and Volkswagen, Toyota not only has to eliminate the brand shadow caused by the recall, suffers from the slow climb of overseas key markets such as North America, and urgently reorganizes the internal operating system, but also has to face the strong earthquake belt. The supply system that has come may have a crisis of collapse.

According to our understanding, after Toyota’s 63% decline in Japan’s domestic production in March this year (a record low since 1976), the production in April and May will still face severe challenges: the Japanese factory will go until April 28th. The production was suspended on May 9. The operating rate was only about 50% before June 3. Toyota's factories in China (including joint venture factories) also made similar adjustments: Before June 3, the operating rate of all vehicle factories was halved. In extreme cases, or down to 30%, the production schedules of the various parts factories are adjusted accordingly, and the summer holidays originally planned for implementation after July are also adjusted to the end of April or the beginning of May. The production schedule of the China plant after June 6 (Monday) will also depend on the availability of parts and components. At the same time, Toyota’s factories in North America and Europe also suffered stoppages or reduced production due to insufficient supply of spare parts, and this “unconventional†production situation will continue for quite some time. Toyota’s official estimate If all of its factories around the world are to be restored to normal production levels, they will need to wait at least until November or December of this year.

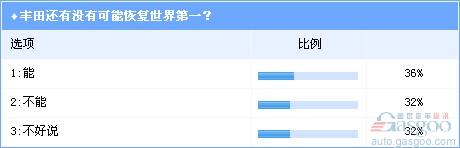

Based on the above series of influencing factors, most domestic and foreign organizations and professionals believe that Toyota's production and sales volume this year will be between 6.3 million and 7 million units. Combining the growth momentum of GM and Volkswagen, Toyota is left behind by the latter two companies. Behind the industry seems to have become inevitable. After suffering such a heavy blow, once Toyota’s prediction that its global market position is surpassed by GM, Volkswagen and even Hyundai will finally be realized, it will be extremely difficult for Toyota to regain control of the global automotive market. In the survey (see Figure 2) we can see that only 36% of people are happy to see Toyota's recovery of the "world number one" expectation, and those who are bearish and unwilling are 32% each. Toyota has indeed reached the stage of "struggling for survival".

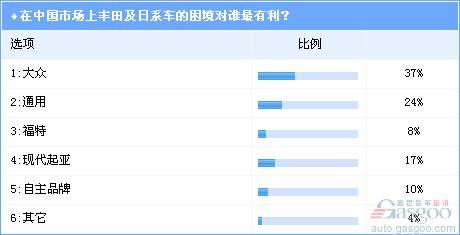

The Chinese market will be the key battlefield where Toyota can regain its brilliance and lead the world in the future. Only “China†can be the “worldâ€. However, as the chief representative of the Japanese brand, Toyota (and other Japanese brands) are currently suffering from the earthquake, which inevitably will give the other competitors in the Chinese market a chance to share the Japanese car market share once. The results of the survey (see Figure 3) show that 37%, 24%, and 17% of Volkswagen, GM, and Hyundai are considered to be the biggest winners of the Japanese car crisis. At the same time, the self-owned brands and Ford also received 10% and 8% of the votes, which shows that in the noise reduction and stoppage production, Japanese cars will hardly maintain their existing market share. The interests are dipping.

After sales profits surpassed that of General Motors and Toyota in the whole year, the number one sales position in the world is the target that the public has been clamouring for over the past two years. In the Chinese market, it has become the world's largest new car sales market, and it can continue to maintain a high growth trend, undoubtedly becoming the decisive place for the world's biggest players in the world.

In November 2009, Volkswagen officially launched the “South Strategy†in the Chinese market: the sales target for new vehicles in the South China market was increased from the original 150,000 units to 500,000 units, and the market share increased from 12% in 2008 to the Group’s average market in the country. Occupancy rate. The South Market has always been the largest base for Japanese cars. The implementation of the Volkswagen “Southern Strategy†has pushed competition between itself and Japanese cars represented by Toyota, Honda, and Nissan to the “blade battle†stage, after more than a year of short-sighted battles. In the battle for market share, in 2010 Volkswagen raised the market share of the South to 15%, which to some extent took up the market share of Japanese cars. However, the foundation of Japanese cars in the South market remained stable. However, this strong earthquake in Japan has disrupted the supply chain of many Japanese automakers. GAC Toyota, Guangzhou Automobile Honda, Dongfeng Honda, and Dongfeng Nissan have all been forced to reduce production due to insufficient supply of parts and components. Tearing a hole that can take advantage of the market, market share is likely to be eaten up by the public.

Compared with the general public, the "place of blame" between GM and Toyota has a long history. Since surpassing GM in 2008 to become the world's largest auto group, the two sides have become more intense in their fights. In the North American market, the dynamism of Nirvana’s rejuvenated market has doubled and its parts suppliers in Japan have begun to gradually recover from the earthquake crisis, further widening the gap with Toyota (Toyota has not fully emerged from the recall crisis). According to our current statistics on light vehicle sales in the US market, GM achieved sales of 232,538 units in April, its market share increased from 18.7% in the same period last year to 20.1%, and Toyota sold 159,540 units in sales. The share fell from 16.1% to 13.8%.

In the Chinese market, Toyota has been unable to keep pace with GM. During the Shanghai Auto Show, GM China released a strategy for the next five years: It will continue to spend US$1.0 billion to US$1.5 billion annually on construction projects, production facilities and after-sales infrastructure construction in China. The total investment is expected to reach 2015. The amount will reach 50-75 billion U.S. dollars, and in 2015 it will achieve the goal of 5 million vehicles sold in China. In contrast, Toyota's target in the Chinese market in 2015 was set at 1.5 million vehicles. The earthquake crisis is undoubtedly another major dilemma for Toyota after going through the recall crisis. General Motors once again took the initiative.

Japanese cars and Korean cars have many common points in terms of their growth models and product quality. Some consumers often compare these two models with each other. Therefore, the Toyota, Honda and other Japanese cars have suffered a crisis of production cuts and gave rise to a favorable opportunity for Hyundai to force its market share. At the same time, with the increasing sales year by year, the Korean automaker, which operates two major auto brands, Hyundai and Kia, is gaining momentum into the top three in the world. Judging from the market performance of the Hyundai Group, Toyota may even be overtaken by this nearby competitor this year. It is understood that the target of this year's Hyundai Group is set at 6.33 million, an increase of 10% over the same period last year. Among them, Kia Motors has performed well and it is not an impossible task for Hyundai to become the fourth player in the world from this year (Hyundai Group sold more than 7,000 Toyotas in global sales in March).

Japanese cars such as Toyota are undergoing a series of tests brought about by the earthquake crisis. How to maintain the stability of the Chinese market is the key to whether or not the crisis can be successfully overcome. According to the voting results (see Figure 4), 33% of the respondents believe that adjusting production according to the actual situation of the supply chain is the most practical measure that Japanese car manufacturers such as Toyota should take. From the current announcement that Toyota, Honda, etc. have made appropriate production cuts and production cuts for Chinese joint ventures, this measure has been widely adopted. Thirty-two percent of respondents suggested that more efforts be made to develop non-Japanese suppliers to avoid the domino effect of "loss and loss" caused by similar earthquakes. In addition, there are 27% of people believe that Japanese cars such as Toyota can increase the promotion of related models in the Chinese market to keep the existing market share, to avoid long into the second camp.

Shortly after the strong earthquake in Japan, we had targeted more than 120 industry-leading international consulting experts and international vehicle and component companies on the negative impact of the earthquake on Japanese car companies and the global automotive industry chain. Executives conducted a survey, and the results showed that Japanese car companies are optimistic about opening up the "closely matched system" moderately. There are less than 10 persons in the Japanese market. The supply system of Japanese car companies in the Chinese market is unlikely to change significantly in the industry for a short time.

We believe that the earthquake has brought great turmoil to the global strategic deployment of Japanese automakers. If Toyota's global sales fell to the third this year, it will bring serious damage to it. It is imperative to further improve the international operation capabilities and reconstruct the global supporting system. Whether the system will sort out the intrinsic supply chain, weigh the pros and cons of the tightly matched system, and effectively deploy the new competitive structure will be the issues that Toyota and other Japanese cars will have to solve if they can take the lead again in the global automotive industry.

Some agencies predict that Toyota’s global sales will fall below 7 million vehicles in 2011 under the impact of the financial crisis, the global large-scale recall incident and the earthquake. This means that Toyota’s global ranking is likely to be in the General Motors and the Volkswagen. after that. In our latest issue, 2916 industry participants were attracted to participate in the voting. The results of the industry survey focused on this topic also showed (see Figure 1). Those who accounted for 71% of the total number of voters think that this year Toyota will fall from the number one in the world to No. Third, only 12% of those who hold opposing views, while 17% are still waiting to see.

This judgment is not without reason. In 2010, Toyota, which suffered from global recalls, ranked first in sales of 8.42 million units. GM and Volkswagen each ranked 8.23 ​​and 7.14 million. According to our comparison of the growth rate of the top ten auto giants in the global sales ranking in 2010, Toyota's 7.7% year-on-year increase was only 4.8% higher than that of Honda. Both were lower than the other eight companies and were aggressively chased by General Motors. Next, it is not easy for Toyota to sit in the top spot. At the same time, in the current rapid rise of GM and Volkswagen, Toyota not only has to eliminate the brand shadow caused by the recall, suffers from the slow climb of overseas key markets such as North America, and urgently reorganizes the internal operating system, but also has to face the strong earthquake belt. The supply system that has come may have a crisis of collapse.

According to our understanding, after Toyota’s 63% decline in Japan’s domestic production in March this year (a record low since 1976), the production in April and May will still face severe challenges: the Japanese factory will go until April 28th. The production was suspended on May 9. The operating rate was only about 50% before June 3. Toyota's factories in China (including joint venture factories) also made similar adjustments: Before June 3, the operating rate of all vehicle factories was halved. In extreme cases, or down to 30%, the production schedules of the various parts factories are adjusted accordingly, and the summer holidays originally planned for implementation after July are also adjusted to the end of April or the beginning of May. The production schedule of the China plant after June 6 (Monday) will also depend on the availability of parts and components. At the same time, Toyota’s factories in North America and Europe also suffered stoppages or reduced production due to insufficient supply of spare parts, and this “unconventional†production situation will continue for quite some time. Toyota’s official estimate If all of its factories around the world are to be restored to normal production levels, they will need to wait at least until November or December of this year.

Based on the above series of influencing factors, most domestic and foreign organizations and professionals believe that Toyota's production and sales volume this year will be between 6.3 million and 7 million units. Combining the growth momentum of GM and Volkswagen, Toyota is left behind by the latter two companies. Behind the industry seems to have become inevitable. After suffering such a heavy blow, once Toyota’s prediction that its global market position is surpassed by GM, Volkswagen and even Hyundai will finally be realized, it will be extremely difficult for Toyota to regain control of the global automotive market. In the survey (see Figure 2) we can see that only 36% of people are happy to see Toyota's recovery of the "world number one" expectation, and those who are bearish and unwilling are 32% each. Toyota has indeed reached the stage of "struggling for survival".

The Chinese market will be the key battlefield where Toyota can regain its brilliance and lead the world in the future. Only “China†can be the “worldâ€. However, as the chief representative of the Japanese brand, Toyota (and other Japanese brands) are currently suffering from the earthquake, which inevitably will give the other competitors in the Chinese market a chance to share the Japanese car market share once. The results of the survey (see Figure 3) show that 37%, 24%, and 17% of Volkswagen, GM, and Hyundai are considered to be the biggest winners of the Japanese car crisis. At the same time, the self-owned brands and Ford also received 10% and 8% of the votes, which shows that in the noise reduction and stoppage production, Japanese cars will hardly maintain their existing market share. The interests are dipping.

After sales profits surpassed that of General Motors and Toyota in the whole year, the number one sales position in the world is the target that the public has been clamouring for over the past two years. In the Chinese market, it has become the world's largest new car sales market, and it can continue to maintain a high growth trend, undoubtedly becoming the decisive place for the world's biggest players in the world.

In November 2009, Volkswagen officially launched the “South Strategy†in the Chinese market: the sales target for new vehicles in the South China market was increased from the original 150,000 units to 500,000 units, and the market share increased from 12% in 2008 to the Group’s average market in the country. Occupancy rate. The South Market has always been the largest base for Japanese cars. The implementation of the Volkswagen “Southern Strategy†has pushed competition between itself and Japanese cars represented by Toyota, Honda, and Nissan to the “blade battle†stage, after more than a year of short-sighted battles. In the battle for market share, in 2010 Volkswagen raised the market share of the South to 15%, which to some extent took up the market share of Japanese cars. However, the foundation of Japanese cars in the South market remained stable. However, this strong earthquake in Japan has disrupted the supply chain of many Japanese automakers. GAC Toyota, Guangzhou Automobile Honda, Dongfeng Honda, and Dongfeng Nissan have all been forced to reduce production due to insufficient supply of parts and components. Tearing a hole that can take advantage of the market, market share is likely to be eaten up by the public.

Compared with the general public, the "place of blame" between GM and Toyota has a long history. Since surpassing GM in 2008 to become the world's largest auto group, the two sides have become more intense in their fights. In the North American market, the dynamism of Nirvana’s rejuvenated market has doubled and its parts suppliers in Japan have begun to gradually recover from the earthquake crisis, further widening the gap with Toyota (Toyota has not fully emerged from the recall crisis). According to our current statistics on light vehicle sales in the US market, GM achieved sales of 232,538 units in April, its market share increased from 18.7% in the same period last year to 20.1%, and Toyota sold 159,540 units in sales. The share fell from 16.1% to 13.8%.

In the Chinese market, Toyota has been unable to keep pace with GM. During the Shanghai Auto Show, GM China released a strategy for the next five years: It will continue to spend US$1.0 billion to US$1.5 billion annually on construction projects, production facilities and after-sales infrastructure construction in China. The total investment is expected to reach 2015. The amount will reach 50-75 billion U.S. dollars, and in 2015 it will achieve the goal of 5 million vehicles sold in China. In contrast, Toyota's target in the Chinese market in 2015 was set at 1.5 million vehicles. The earthquake crisis is undoubtedly another major dilemma for Toyota after going through the recall crisis. General Motors once again took the initiative.

Japanese cars and Korean cars have many common points in terms of their growth models and product quality. Some consumers often compare these two models with each other. Therefore, the Toyota, Honda and other Japanese cars have suffered a crisis of production cuts and gave rise to a favorable opportunity for Hyundai to force its market share. At the same time, with the increasing sales year by year, the Korean automaker, which operates two major auto brands, Hyundai and Kia, is gaining momentum into the top three in the world. Judging from the market performance of the Hyundai Group, Toyota may even be overtaken by this nearby competitor this year. It is understood that the target of this year's Hyundai Group is set at 6.33 million, an increase of 10% over the same period last year. Among them, Kia Motors has performed well and it is not an impossible task for Hyundai to become the fourth player in the world from this year (Hyundai Group sold more than 7,000 Toyotas in global sales in March).

Japanese cars such as Toyota are undergoing a series of tests brought about by the earthquake crisis. How to maintain the stability of the Chinese market is the key to whether or not the crisis can be successfully overcome. According to the voting results (see Figure 4), 33% of the respondents believe that adjusting production according to the actual situation of the supply chain is the most practical measure that Japanese car manufacturers such as Toyota should take. From the current announcement that Toyota, Honda, etc. have made appropriate production cuts and production cuts for Chinese joint ventures, this measure has been widely adopted. Thirty-two percent of respondents suggested that more efforts be made to develop non-Japanese suppliers to avoid the domino effect of "loss and loss" caused by similar earthquakes. In addition, there are 27% of people believe that Japanese cars such as Toyota can increase the promotion of related models in the Chinese market to keep the existing market share, to avoid long into the second camp.

Shortly after the strong earthquake in Japan, we had targeted more than 120 industry-leading international consulting experts and international vehicle and component companies on the negative impact of the earthquake on Japanese car companies and the global automotive industry chain. Executives conducted a survey, and the results showed that Japanese car companies are optimistic about opening up the "closely matched system" moderately. There are less than 10 persons in the Japanese market. The supply system of Japanese car companies in the Chinese market is unlikely to change significantly in the industry for a short time.

We believe that the earthquake has brought great turmoil to the global strategic deployment of Japanese automakers. If Toyota's global sales fell to the third this year, it will bring serious damage to it. It is imperative to further improve the international operation capabilities and reconstruct the global supporting system. Whether the system will sort out the intrinsic supply chain, weigh the pros and cons of the tightly matched system, and effectively deploy the new competitive structure will be the issues that Toyota and other Japanese cars will have to solve if they can take the lead again in the global automotive industry.

Carbon Steel Pipes can be divided into seamless steel pipes, straight seam steel pipes, spiral steel pipes, high frequency welded steel pipes, etc.

Seamless Steel Pipe,Seamless Steel Tube,Seamless Steel Pipes,Structural Steel Pipes,Welded Steel Pipe

Shandong Rizhaoxin Metal Products Co., Ltd. , https://www.sdrizhaoxinsteel.com